Choosing Between a 15-Year and 30-Year Fixed-Rate Mortgage: Which Loan Term is Right for You?…

Demystifying Mortgage Rates

Demystifying Mortgage Rates: The Role of Credit Scores in Home Financing

In today’s dynamic mortgage market, understanding the interplay between credit scores and mortgage rates is essential for borrowers seeking to finance their dream homes. With interest rates fluctuating and lending criteria evolving, navigating the complexities of mortgage financing requires a nuanced understanding of how creditworthiness impacts borrowing costs. This comprehensive guide aims to demystify the relationship between credit scores and mortgage rates, empowering borrowers to make informed decisions and secure favorable terms for their home loans.

The Significance of Credit Scores in Mortgage Rates:

Credit scores are a crucial metric for lenders assessing the risk of extending mortgage loans. A borrower’s credit score reflects their creditworthiness based on factors such as payment history, outstanding debts, length of credit history, and types of credit accounts. Lenders use credit scores to gauge the likelihood of borrowers defaulting on their loans, with higher scores indicating lower risk and vice versa.

Impact on Borrowing Costs:

The impact of credit scores on borrowing costs cannot be overstated. Even minor differences in credit scores can translate into significant variations in mortgage rates. Borrowers with excellent credit scores typically qualify for the lowest available rates, while those with subpar credit may face higher interest rates or struggle to obtain financing altogether. Understanding how credit scores influence borrowing costs empowers borrowers to take proactive steps to improve their credit profiles and secure more favorable loan terms.

Factors Influencing Mortgage Pricing Adjustments:

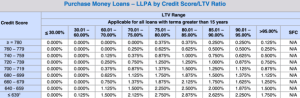

While credit scores play a pivotal role in determining mortgage rates, they are just one component of a broader framework used by lenders to price loans. Fannie Mae’s Loan Level Pricing Adjustments (LLPAs) are a crucial aspect of this framework, encompassing various factors beyond credit scores. These include the loan-to-value ratio, debt-to-income ratio, property type, and loan amount, among others. Lenders meticulously assess these factors to gauge the overall risk associated with a loan and adjust rates accordingly.

Fannie Mae’s LLPAs serve as a risk-based pricing mechanism, wherein borrowers with higher-risk profiles may incur additional costs in the form of rate adjustments. For instance, borrowers with higher loan-to-value ratios or lower down payments may face higher LLPAs to mitigate the increased risk to lenders. Similarly, factors such as property type and loan amount can also impact the pricing adjustments applied to a loan.

Optimizing these factors alongside maintaining healthy credit scores can significantly enhance borrowers’ loan eligibility and access to more favorable rates. Borrowers can mitigate risk factors by strategically managing their loan-to-value ratios, debt-to-income ratios, and property types and potentially qualify for lower LLPAs. This holistic approach to loan eligibility empowers borrowers to maximize their chances of securing competitive rates and achieving their homeownership goals.

Navigating Pricing Adjustments:

Understanding how lenders assess risk and apply pricing adjustments is key to navigating the mortgage financing landscape. For instance, borrowers with higher loan-to-value ratios or lower down payments may face additional pricing adjustments to offset the increased risk to lenders. Similarly, borrowers seeking non-traditional loan products or financing for investment properties may encounter higher rates due to the perceived risk associated with these transactions. By comprehensively evaluating their financial profiles and addressing potential risk factors, borrowers can mitigate pricing adjustments and secure more competitive rates.

The Role of FICO Scores in Mortgage Financing:

FICO scores, developed by the Fair Isaac Corporation, are widely used by lenders to assess credit risk and determine loan eligibility. These scores range from 300 to 850, with higher scores indicating lower credit risk. Mortgage lenders typically rely on FICO scores to evaluate borrowers’ creditworthiness and assign appropriate interest rates. While the specific scoring models may vary among lenders, FICO scores remain a fundamental factor in mortgage underwriting and pricing decisions.

Understanding Credit Score Tiers:

Credit score tiers categorize borrowers based on their creditworthiness and help lenders assess risk more effectively. Borrowers with excellent credit scores (usually 780 or above) are considered low-risk and qualify for the best available rates and terms. As credit scores decline, borrowers may face higher rates and more stringent eligibility requirements. Understanding credit score tiers enables borrowers to gauge their standing in the lending market and take proactive steps to improve their credit profiles.

Navigating Changes in Credit Score Requirements:

Recent changes in credit score requirements by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac have further underscored the importance of maintaining high credit scores. These entities establish guidelines for mortgage lending and often set minimum credit score requirements for loans eligible for purchase or securitization. As GSEs adjust their credit score thresholds, borrowers must adapt and strive to meet the evolving criteria to access the most favorable mortgage terms.

Strategies for Improving Credit Scores:

Improving credit scores is a proactive process that requires diligence and discipline. By implementing sound financial practices and addressing negative factors impacting their credit profiles, borrowers can enhance their creditworthiness and qualify for better mortgage rates. Strategies for improving credit scores include:

- Paying bills on time: Timely payment of bills, including credit card bills, loans, and utility bills, demonstrates responsible financial behavior and positively impacts credit scores.

- Managing credit utilization: Keeping credit card balances low relative to credit limits can improve credit scores and signal responsible credit management to lenders.

- Limiting new credit applications: Applying for multiple new credit accounts within a short period can lower credit scores and suggest financial instability to lenders.

- Monitoring credit reports: Regularly reviewing credit reports allows borrowers to identify inaccuracies or discrepancies and take corrective action to maintain accurate credit profiles.

- Addressing derogatory marks: Resolving past-due accounts, collections, or bankruptcies can help improve credit scores over time and enhance eligibility for mortgage financing.

Preparing for the Mortgage Application Process:

As borrowers prepare to apply for mortgages, thorough preparation and due diligence are paramount. Conducting a comprehensive assessment of credit health, financial stability, and eligibility criteria can streamline the application process and increase the likelihood of approval. Key steps to prepare for the mortgage application process include:

- Obtaining credit reports: Requesting credit reports from major credit bureaus allows borrowers to review their credit histories and identify areas for improvement before applying for mortgages.

- Reviewing credit scores: Understanding credit scores and their implications for mortgage rates enables borrowers to set realistic expectations and explore opportunities for credit improvement.

- Addressing discrepancies: Resolving inaccuracies or discrepancies in credit reports ensures that lenders evaluate borrowers’ creditworthiness accurately and fairly during the application process.

- Organizing financial documentation: Gathering essential financial documents, such as tax returns, pay stubs, bank statements, and investment records, facilitates the mortgage application process and expedites loan approval.

- Consulting with mortgage professionals: Seeking guidance from experienced mortgage professionals can provide valuable insights into loan options, eligibility requirements, and strategies for securing favorable terms.

By proactively addressing these considerations and arming themselves with the necessary information and documentation, borrowers can navigate the mortgage application process with complete confidence and increase their chances for success.

Certified Home Loans believes understanding the intricate relationship between credit scores and mortgage rates is essential for borrowers seeking to finance their homes. By comprehensively evaluating their credit health, financial profiles, and eligibility criteria, borrowers can position themselves for success in the mortgage application process and secure more competitive loan terms. By prioritizing credit improvement, diligent preparation, and strategic decision-making, borrowers can achieve their homeownership goals and embark on a path to financial stability and prosperity.