Understanding Closing Costs with VA Loans in Raleigh, NC

Navigating the home-buying process in Raleigh, North Carolina, can be both exciting and complex, especially for veterans and active-duty service members utilizing VA loans. A critical component of this journey is understanding the closing costs associated with VA loans and how they impact your home purchase.

What Are Closing Costs?

Closing costs encompass various fees and expenses that buyers and sellers incur to finalize a real estate transaction. These costs typically include charges for loan origination, appraisals, title searches, and other services essential to the home-buying process. For VA loans, while there’s no requirement for a down payment, closing costs are still applicable.

VA Loan Closing Costs: An Overview

When utilizing a VA loan, certain closing costs are unique to this type of financing:

-

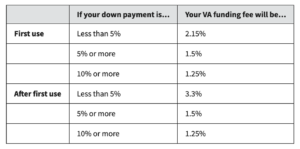

VA Funding Fee: This is a mandatory fee applied to most VA loans, calculated as a percentage of the loan amount. The fee varies based on factors such as your military service category, whether it’s your first time using a VA loan, and the amount of your down payment. For example, first-time users with no down payment typically pay a funding fee of 2.3% of the loan amount.

-

Appraisal Fee: The VA requires an appraisal to assess the property’s value and ensure it meets minimum property requirements. In North Carolina, appraisal fees generally range from $525 to $1,550, depending on the property’s location and complexity.

-

Origination Fee: Lenders may charge an origination fee to cover the costs of processing the loan. The VA limits this fee to 1% of the loan amount.

-

Other Fees: Additional costs may include title insurance, recording fees, and credit report fees.

Who Pays Closing Costs in a VA Loan?

In a VA loan transaction, the buyer is typically responsible for certain closing costs. However, the VA allows sellers to contribute up to 4% of the home’s purchase price toward the buyer’s closing costs and other expenses. This can include the VA funding fee, property taxes, insurance, and even paying off collections or judgments on behalf of the buyer. Negotiating seller concessions can significantly reduce the out-of-pocket expenses for VA borrowers.

Strategies to Manage Closing Costs in Raleigh

For Raleigh area homebuyers, there are several strategies to manage and potentially reduce closing costs:

1. Negotiate Seller Concessions

Given the VA’s allowance for seller concessions, buyers can negotiate with sellers to cover a portion of the closing costs. This negotiation can be particularly effective in a buyer’s market where sellers are motivated to close deals.

2. Utilize Local Assistance Programs

Raleigh offers various programs to assist homebuyers with closing costs:

-

City of Raleigh Homebuyer Assistance Program: Provides zero-interest loans to help with down payments and closing costs. These loans are deferred, with no payments due until the home is sold or no longer used as the primary residence.

-

NC 1st Home Advantage Down Payment: Offers eligible first-time homebuyers and military veterans $15,000 in down payment assistance, which can also be applied toward closing costs. This assistance is structured as a 0% deferred second mortgage, forgiven after 15 years.

3. Explore Lender Credits

Some lenders may offer credits to offset closing costs in exchange for a slightly higher interest rate. This can be a viable option for buyers looking to minimize upfront expenses, though it’s essential to evaluate the long-term financial implications.

Resources for VA Loan Applicants

At Certified Home Loans, we are committed to guiding you through the VA loan process. Our resources include:

-

VA Learning Center: Access comprehensive information about VA loans, eligibility requirements, and benefits.

-

Pre-Qualification Assistance: Begin your home-buying journey by determining your eligibility and loan options with our expert team.

-

Mortgage Calculators: Utilize our tools to estimate your monthly payments, assess affordability, and plan your finances effectively.

Conclusion

Understanding and managing closing costs is a crucial aspect of purchasing a home with a VA loan in Raleigh, NC. By familiarizing yourself with the associated fees, exploring local assistance programs, and leveraging available resources, you can navigate the process more efficiently and make informed financial decisions. For personalized guidance and support, consider reaching out to Certified Home Loans to ensure a smooth and successful home-buying experience.