Everything You Need to Know About Jumbo Loans in Raleigh, NC

As Raleigh continues to attract new residents and grow into a hub of luxury living, more homebuyers are seeking financing options beyond conventional mortgage limits. If you’re looking to purchase a high-value home in the Triangle area, a jumbo loan could be the key to securing your dream property without compromise.

At Certified Home Loans, we specialize in helping clients navigate the jumbo loan process with confidence and clarity. In this guide, we’ll walk you through what jumbo loans are, who they’re for, what it takes to qualify, and why working with a local lender like Certified Home Loans makes all the difference.

What Is a Jumbo Loan?

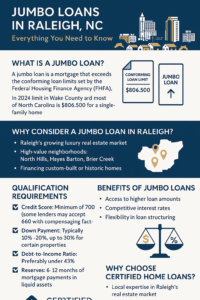

A jumbo loan, also known as a non-conforming loan, is a mortgage that exceeds the loan limits set annually by the Federal Housing Finance Agency (FHFA). These limits define the maximum loan amount that Fannie Mae and Freddie Mac will purchase from lenders.

As of 2026, the conforming loan limit in Wake County and most of North Carolina is $832,750 for a single-family home. If you’re financing a home priced above that threshold, you’ll likely need a Jumbo mortgage.

Because they fall outside of government-backed loan programs, jumbo loans carry more risk for lenders, meaning they come with stricter qualification standards, but also more flexibility in terms of structure and loan size.

Why Raleigh Buyers Are Turning to Jumbo Loans

Raleigh’s booming economy, tech sector, and quality of life have turned it into one of the most desirable real estate markets in the Southeast. Home values in the city and surrounding suburbs like Cary, Apex, and Chapel Hill are climbing rapidly. According to Zillow, the average home value in Raleigh now hovers around $430,000, while luxury homes and new construction properties can easily reach $1 million or more.

For buyers interested in:

-

Luxury homes in upscale neighborhoods like North Hills, Hayes Barton, or Brier Creek

-

Large estates or historic properties

-

Custom-built homes on acreage

-

Investment properties in growing areas

…a jumbo loan may be the ideal solution for covering your financing needs without having to split the loan across multiple mortgages.

Jumbo Loan Requirements in North Carolina

While jumbo loans offer flexibility and high borrowing power, they do come with more stringent eligibility requirements than conventional loans. Here’s what most lenders—including Certified Home Loans—look for:

1. Credit Score

A strong credit profile is essential. Most lenders require a minimum credit score of 700, though borrowers with scores as low as 660 may still qualify with compensating factors like higher income or a larger down payment.

2. Down Payment

Expect to put down at least 10% to 20% on a jumbo loan. Some lenders require up to 30%, particularly for second homes or investment properties. Certified Home Loans works with a variety of lenders, giving our clients access to low-down-payment jumbo options when available.

3. Debt-to-Income Ratio (DTI)

Lenders prefer a DTI ratio under 43%, though some may go higher for exceptionally strong borrowers. This means your total monthly debt payments—including your new mortgage—should not exceed 43% of your gross monthly income.

4. Income and Asset Documentation

You’ll need to provide comprehensive documentation showing steady, verifiable income (W-2s, tax returns, business income, etc.) and liquid assets. Many lenders require borrowers to have six to twelve months of mortgage payments in reserves.

5. Appraisal Requirements

Because jumbo loans involve higher loan amounts, lenders often require two property appraisals, especially for loans over $2 million.

Benefits of Jumbo Loans

While jumbo loans are designed for high-value properties, they also offer several unique benefits:

✅ Higher Loan Limits

Purchase luxury homes or high-end real estate without being restricted by conforming loan caps.

✅ Flexible Loan Terms

Choose from fixed-rate or adjustable-rate mortgages (ARMs), with options that suit both long-term homeowners and short-term investors.

✅ Competitive Interest Rates

Contrary to what many assume, jumbo loan rates can be comparable—or even lower—than conventional loans, especially for well-qualified borrowers.

✅ No Private Mortgage Insurance (PMI) in Some Cases

Some jumbo loans waive PMI even if you put down less than 20%, depending on your lender and credit profile.

Certified Home Loans: Raleigh’s Jumbo Loan Experts

At Certified Home Loans, we know that navigating the world of high-value home financing can feel overwhelming. That’s why we provide a streamlined, personal experience to make your jumbo loan process as easy and stress-free as possible.

Here’s how we support our clients:

🏠 Pre-Qualification

We’ll evaluate your financial situation and discuss your goals to determine the jumbo loan amount you’re likely to qualify for.

📄 Application Assistance

Our team walks you through every step of the paperwork, ensuring nothing is missed that could delay your approval.

💰 Rate Shopping

We work with a network of top-tier jumbo lenders across North Carolina to find the most competitive rate and loan structure for your needs.

🔍 Local Insight

With deep knowledge of the Raleigh-Durham-Chapel Hill housing market, we can help you align your financing with the realities of local pricing, appraisals, and demand.

Steps to Secure a Jumbo Loan with Certified Home Loans

Here’s what you can expect during your jumbo loan journey:

-

Initial Consultation – Chat with a Certified Home Loans advisor about your goals and loan options.

-

Pre-Approval – Gather financial documents and get pre-approved, giving you a strong negotiating position when house hunting.

-

Home Search – Work with your real estate agent to find a property that fits your budget and lifestyle.

-

Full Application & Underwriting – Submit your application, along with income, asset, and property documentation.

-

Closing – Once approved, we’ll guide you through the closing process and celebrate your new home!

Final Thoughts: Is a Jumbo Loan Right for You?

If you’re shopping for a home in one of Raleigh’s premier neighborhoods or eyeing a custom-built dream home, a jumbo mortgage could be your best path forward. These loans offer the flexibility and power you need to invest in a high-value property—without unnecessary complexity.

With the guidance of Certified Home Loans, securing a jumbo loan in Raleigh doesn’t have to be intimidating. Our local team of mortgage professionals is committed to delivering a transparent, efficient, and tailored experience from pre-qualification to closing.

💬 Ready to Take the First Step?

Contact Certified Home Loans today to schedule a free consultation and explore your jumbo loan options in Raleigh, NC. Let’s turn your luxury home goals into reality.