Buying your first home in Raleigh, NC is an exciting milestone, but it can also…

Navigating the Paper Trail: Understanding the Mortgage Application Process

Navigating the Paper Trail: Understanding the Mortgage Application Process

Embarking on a journey to refinance your home loan or secure a mortgage for a new property can seem like diving headfirst into a sea of paperwork. But fear not, as understanding each document’s purpose can make this process smoother and more manageable.

Understanding the Initial Disclosures

To kickstart the mortgage process, you’ll encounter a bundle of documents, each serving a crucial role. From the Loan Estimate (LE) to authorization forms, these disclosures provide vital insights into your loan and the involved parties. They pave the way for lenders to access essential information like your credit history, employment details, and financial statements.

Without these disclosures, lenders would lack the necessary documentation to assess your eligibility accurately. Thus, signing these forms marks the formal beginning of your loan journey.

- Initial disclosures are the preliminary disclosures that must be acknowledged and signed to move forward with your loan application. These disclosures outline the initial terms of the mortgage application and also include federal and state-required mortgage disclosures. The most important items to keep in mind are the mortgage loan application, loan estimate, and program-specific disclosures. When you apply for a mortgage loan, the lender is required to provide you with initial disclosures within three business days of application. Initial disclosures let you know what you can expect in terms of cost, monthly payments, and loan structure. While these terms are not final, they generally will not increase unless there is a legitimate change in circumstance.

What is considered a change in circumstance?

The loan process, between application and closing, takes time. There will likely be changes along the way, and some changes may require First Tech to re-disclose. These changes could be things such as the appraised value of your home coming in higher or lower than expected, a change in your income or credit, or any other item that would be related to finances. If any changes during your loan process result in a different loan cost, First Tech will disclose the updated terms within three business days.

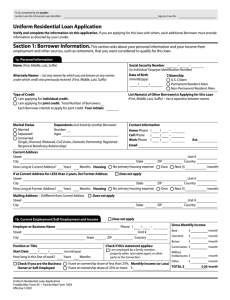

The Core Document: Uniform Residential Loan Application (1003)

At the heart of your mortgage application lies the Uniform Residential Loan Application (URLA), commonly known as Form 1003. This comprehensive document captures various facets of your personal and financial life, including employment history, assets, liabilities, and details about the subject property.

Moreover, it delves into specifics such as the proposed loan amount, transaction type, and property value, providing a holistic overview of the lender’s evaluation.

Streamlining the Process with Electronic Signatures

Gone are the days of cumbersome paperwork, thanks to technological advancements. Nowadays, many disclosures and forms can be conveniently signed electronically, simplifying the initiation stage of your mortgage journey.

This digital transformation not only reduces paperwork hassles but also accelerates the process, allowing for smoother interactions between borrowers and lenders.

Submission and Underwriting: A Crucial Stage

Once the initial disclosures are squared away, your loan officer or mortgage broker will gather essential documents and submit your application to the underwriting department. Here, the underwriter meticulously assesses your financial profile, ensuring compliance with lending criteria.

Upon approval, you’ll receive conditional approval along with a set of conditions to fulfill before proceeding to the next phase. These conditions, known as “before document” requirements, must be met for the issuance of loan documents.

Meeting Documentation Requirements

Mortgage lenders have specific documentation requirements to validate your financial standing and assess risk. From bank statements to tax returns, each document plays a pivotal role in the underwriting process.

Furthermore, depending on your employment status and loan type, additional documentation such as gift letters or CPA letters may be necessary to provide clarity and assurance to the lender.

Tailoring Documentation to Your Loan Type

Different loan types necessitate varying levels of documentation. Whether you opt for full documentation, bank statements, stated income, or no documentation loans, understanding the requirements specific to your loan type is essential for a seamless application process.

What Documents Do Mortgage Lenders Require?

Depending on the specific loan program, a variety of documents may be requested.

Bank statements: These document that the assets of the applicant are held in a verifiable account, such as a checking or savings account. They are necessary for proof of funds for down payment, closing costs, and reserves. Statements for an investment account, or retirement account such as a 401k may also be provided.

Pay stubs & W-2s: A statement that includes your gross pay, taxes, deductions, and net pay. They are required to validate income that is steady or increasing with a stable employment history.

Tax returns: If an applicant is self-employed or has another layer of income verification, tax returns for the last two filing years may be required to validate steady income.

Credit report: Required to document your credit history and credit scores. Typically a tri-merge report includes scores and data from the three credit reporting agencies (Equifax, Experian, TransUnion).

Employment history: Typically verified with a Request for Verification of Employment form, known as a VOE. Details the date of employment, current title, gross pay, and likelihood of continued employment. This will validate that the employment is steady and reliable.

Rental history: This can be verified via a Verification of Rent form, known as a VOR, canceled checks, or a statement from the property management company. This will document the applicant’s history of paying rent and any late payments.

Gift letter: Required if any applicant is receiving a gift for the down payment and/or closing costs.

CPA letter: If an applicant is self-employed, a letter from the applicant’s CPA may be necessary to explain your employment or specific information within your tax returns that the underwriter may need to clarify.

Home appraisal: Typically required to determine the value of the subject property, which will dictate down payment, loan-to-value ratio (LTV), etc. Unless you receive an appraisal waiver.

Preliminary title report: Ordered to ensure the property is free of any outstanding liens, taxes, or other claims, and before title insurance can be issued.

Proof of insurance: While you finance your home, you must have insurance that protects the lender’s interest in the property. The lender is essentially a co-owner until the loan is satisfied.

Letter of explanation: In some cases, the applicant may need to submit an “LOE” to explain a question for underwriting. Typically, this is a short statement signed by the applicant.

Conclusion: Navigating the Mortgage Maze

While the mortgage application process may appear daunting, understanding the purpose and significance of each document can alleviate uncertainties and streamline the journey. With the right knowledge and preparation, Certified Home Loans can help navigate the paperwork maze with confidence, inching closer to your homeownership goals.